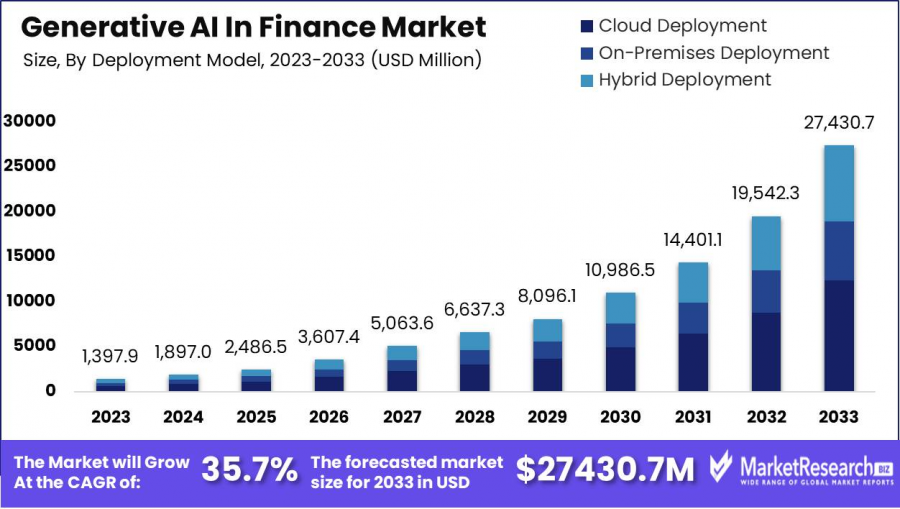

Generative AI in Finance Market Displays Huge Growth By USD 27,430.7 Million by 2033 at a CAGR of 35.7%

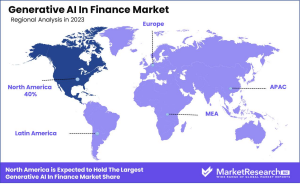

Regional Dominance: North America leads the generative AI finance market, setting global benchmarks with a 40% share...

NEW YORK, NY, UNITED STATES, January 31, 2025 /EINPresswire.com/ -- The Generative AI in Finance Market is experiencing significant growth, projected to expand from USD 1,397.9 million in 2023 to USD 27,430.7 million by 2033 at a CAGR of 35.7%. This rapid expansion is driven by the integration of AI technologies that enhance efficiency and accuracy in financial operations.

Generative AI facilitates advanced financial forecasting, fraud detection, and personalized customer services, addressing the need for increased productivity and detailed analysis in the financial sector.

By automating complex processes and improving decision-making capabilities, generative AI is transforming traditional finance operations. Key benefits include reducing operational risks and costs, as well as improving customer satisfaction through tailored financial advice.

🔴 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://marketresearch.biz/report/generative-ai-in-finance-market/request-sample/

Moreover, AI's ability to adapt to regulatory changes and market conditions positions it as a strategic asset in modern finance. This technology’s adoption is especially prevalent in risk management and investment research, promising substantial returns on investment and competitive advantages for financial institutions that embrace these innovations.

The financial sector’s shift toward digitalization and AI-driven solutions reflects a growing demand for smarter, more efficient financial practices that can adapt to the fast-paced economic landscape.

Key Takeaways

The market is projected to grow from USD 1,397.9 million in 2023 to USD 27,430.7 million by 2033.

Cloud deployment is a dominant model due to its cost-efficiency and scalability.

Generative AI is crucial in enhancing risk management and predictive analytics.

AI-driven fraud detection could save businesses approximately $12 billion annually.

Personalized financial advice through AI significantly boosts customer satisfaction.

🔴 𝐇𝐮𝐫𝐫𝐲 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐅𝐨𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲 @ https://marketresearch.biz/purchase-report/?report_id=37125

Experts Review

Experts underline that governmental policies, coupled with technological innovations, are central to advancing generative AI in the finance sector. Supportive regulations facilitate smoother AI integration into financial systems, essential for handling sensitive data and compliance with privacy standards.

Investment opportunities in generative AI are vast, with significant potential in developing personalized financial services and automated decision-making tools. However, investors face risks such as high development costs and cybersecurity threats, which necessitate robust risk management strategies.

Consumer awareness around AI's role in enhancing financial services is growing, favorably impacting market adoption. Enhanced AI capabilities offer consumers personalized financial solutions, leading to elevated engagement and satisfaction levels.

Technological impacts include profound shifts in operational efficiencies as AI automates routine processes and enhances analytical precision in financial activities. This transition is transforming how financial institutions conduct business, delivering cost savings and improved data management capabilities.

Regulatory environments worldwide are adapting to incorporate AI frameworks, providing guidelines that facilitate ethical and effective AI usage in finance. These frameworks help mitigate risks associated with data privacy and security, ensuring that financial institutions can exploit AI's full potential without compromising customer trust or compliance requirements.

🔴 𝐕𝐢𝐞𝐰 𝐏𝐃𝐅 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐒𝐚𝐦𝐩𝐥𝐞 @ https://marketresearch.biz/report/generative-ai-in-finance-market/request-sample/

Report Segmentation

The report segments the Generative AI in Finance Market by deployment model, application, and technology. Deployment models include cloud, on-premises, and hybrid solutions, with cloud deployment leading due to its flexibility and economic efficiency. This deployment model supports the scalability needed for AI applications in finance, facilitating widespread adoption.

Applications cover risk management, fraud detection, investment research, and trading algorithms. Risk management and fraud detection are key areas where AI demonstrates substantial value, using predictive analytics to enhance oversight and operational integrity. In investment research and trading, AI offers dynamic modeling capabilities, allowing firms to adapt strategies in real time.

By technology, the market is categorized into deep learning, natural language processing, computer vision, and reinforcement learning. Deep learning is predominant, providing robust data analysis and pattern recognition capabilities crucial for finance applications. Natural language processing enhances customer interaction and service personalization, driving higher satisfaction rates and engagement.

These segments allow stakeholders to identify opportunities and tailor strategies according to technological trends and consumer demands. As the market expands, a thorough understanding of these segments will be essential in capturing growth and maintaining competitive advantages within the generative AI landscape in finance.

Key Market Segments

Based on the Deployment Model

Cloud Deployment

On-Premises Deployment

Hybrid Deployment

Based on the Application

Risk Management

Fraud Detection

Investment Research

Trading Algorithms

Other Applications

Based on the Technology

Deep Learning Technology

Natural Language Processing Technology

Computer Vision Technology

Reinforcement Learning Technology

Other Technologies

🔴 𝐆𝐞𝐭 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 (𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲) @ https://marketresearch.biz/purchase-report/?report_id=37125

Drivers, Restraints, Challenges, and Opportunities

Drivers: Key drivers for the Generative AI in Finance Market include the growing demand for process automation and enhanced data analytics. AI technologies streamline operations, reduce costs, and boost productivity by automating routine tasks and providing insightful data analysis, which allows firms to make informed decisions rapidly.

Restraints: Data privacy and security concerns act as significant restraints. Financial institutions handle sensitive information that requires stringent measures to prevent breaches. Compliance with strict regulations such as GDPR and CCPA increases operational complexity and cost.

Challenges: The primary challenge is the high cost of AI technology implementation and the subsequent need for skilled personnel to manage these systems. Many smaller firms may find the investment prohibitive, limiting their ability to compete with larger, more technologically equipped organizations.

Opportunities: There are significant opportunities in enhancing customer service through personalized financial recommendations. Generative AI solutions enable firms to deliver tailored experiences at scale, improving customer engagement and loyalty. Additionally, AI-driven advancements in risk assessment and fraud prevention present critical growth areas, offering robust operational improvements and new avenues for market penetration.

Key Player Analysis

Leading players in the Generative AI in Finance Market include IBM Corporation, NVIDIA Corporation, DataRobot, Inc., and Symphony Ayasdi. IBM continues to leverage its extensive expertise in AI to develop innovative financial solutions, enhancing operational efficiencies for financial institutions. NVIDIA's advanced GPU technologies drive computational power needed for complex AI applications, ensuring high-performance analytics and decision-making capabilities.

DataRobot offers automated machine learning platforms, democratizing AI use by simplifying deployment and facilitating predictive analytics accessible to a broader audience. Symphony Ayasdi focuses on topological data analysis, enabling superior insight extraction and risk management solutions.

These companies drive the market's evolution through consistent innovation and strategic deployments across diverse financial applications. Their technological advancements and strategic investments in AI capabilities propel broader adoption and market growth, providing financial institutions with competitive tools indispensable in today's data-driven financial landscape.

Market Key Players

IBM Corporation

NVIDIA Corporation

DataRobot, Inc.

Symphony Ayasdi

AI

Kavout

AlphaSense

Other Key Players

Recent Developments

Recent developments highlight the accelerating integration of AI in finance. In March 2024, FN Media Group emphasized AI's growing impact across industries, particularly in fintech and big data analytics, projecting substantial growth in the global AI market. C3.ai reported a significant 18% revenue increase due to expanded AI application agreements in the banking sector, showcasing generative AI's financial potential.

In January 2024, an EY survey underscored GenAI's transformative impact on various sectors, anticipating surging investments and improved profitability due to AI implementations. However, challenges like privacy concerns and skill gaps persist, necessitating strategic focus on expertise development and data protection to maximize AI benefits.

These developments highlight a shifting financial landscape, where AI's role is progressively critical in driving efficiency, innovation, and competitive advantage. Institutions leveraging AI technologies effectively position themselves as market leaders amidst an ongoing digital transformation towards more agile and responsive financial services.

Conclusion

The Generative AI in Finance Market is set for remarkable growth, driven by advances in automation and increased demand for efficient, data-driven financial services. Despite challenges such as privacy concerns and high implementation costs, the market's potential is significant. Key players like IBM and NVIDIA are leading innovations that enhance financial operations and customer interactions.

As the sector continues to evolve, embracing AI technologies will be critical for firms seeking to remain competitive. These innovations promise not only enhanced efficiency and reduced costs but also new, personalized service opportunities that can revolutionize the finance industry globally.

➤ 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐎𝐭𝐡𝐞𝐫 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐓𝐨𝐩𝐢𝐜𝐬

Generative AI in Construction Market - https://marketresearch.biz/report/generative-ai-in-construction-market/

Generative AI in Private Equity Market - https://marketresearch.biz/report/generative-ai-in-private-equity-market/

Televisions Market - https://marketresearch.biz/report/televisions-market/

Large Format Display (LFD) Market - https://marketresearch.biz/report/large-format-display-lfd-market/

Agricultural Drone Market - https://marketresearch.biz/report/agricultural-drone-market/

Privileged Access Management Solutions Market - https://marketresearch.biz/report/privileged-access-management-solutions-market/

Payment Processing Solution Market - https://marketresearch.biz/report/payment-processing-solution-market/

Fiber Optics Market - https://marketresearch.biz/report/fiber-optics-market/

Mobile Virtual Network Operator (MVNO) Market - https://marketresearch.biz/report/mobile-virtual-network-operator-mvno-market/

High Altitude Aeronautical Platform Stations Market - https://marketresearch.biz/report/high-altitude-aeronautical-platform-stations-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release