Equity Access Group Reveals: How to Maximize the Benefits of Your Reverse Mortgage in 2024

Learn about strategies to maximize reverse mortgage benefits, through options like a growing line of credit, HECM for Purchase, and refinancing.

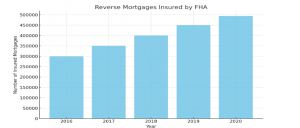

LADERA RANCH, CA, UNITED STATES, October 14, 2024 /EINPresswire.com/ -- As more Americans approach retirement, the need for financial stability becomes paramount. One of the options gaining popularity among retirees is the reverse mortgage—a financial tool allowing homeowners aged 62 and older to convert part of their home equity into cash. At Equity Access Group, we’ve been doing research on how reverse mortgages can help improve their quality of life in retirement.

Understanding Reverse Mortgages:

A reverse mortgage allows homeowners to use the equity they've built in their homes to generate income. Unlike traditional mortgages, there are no monthly payments required. The loan is repaid when the homeowner sells the house or passes away. With an increasing number of retirees struggling to maintain their financial independence, reverse mortgages offer a way to tap into the equity of their homes to supplement their retirement savings.

What Data Tells Us About Financial Challenges in Retirement:

Recent data reveals the financial struggles many retirees face:

- The average retiree’s savings have dropped to $170,726 in 2023, down from $191,659 in 2022.

- 22% of Gen Xers have nothing saved for retirement, and 43% regret not saving more.

- 71% of retirees have non-mortgage debt, averaging $19,888, with nearly 1 in 5 retirees carrying medical debt averaging $10,259.

- 30% of retirees rely solely on Social Security for their income.

According to the Federal Reserve, nearly 30% of retirees depend solely on Social Security, and many hold significant debt, with the average retiree carrying almost $20,000 in non-mortgage debt. This is where a reverse mortgage can help. To get the most out of a reverse mortgage, it’s important to consider options like refinancing when home values go up, using a Home Equity Conversion Mortgage for Purchase (HECM), and taking advantage of a line of credit that grows over time.

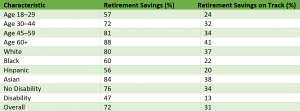

The given table provides insight into retirement savings across various age groups, races/ethnicities, and disability statuses as per the Federal Reserve.

How to Maximize the Benefits of Your Reverse Mortgage:

If you are considering a reverse mortgage, there are several strategies you can use to ensure that you're making the most of this financial tool:

1. Take Advantage of the Non-Borrowing Spouse Provision:

If you are married and one partner is not listed on the reverse mortgage, be sure to explore the Non-Borrowing Spouse Provision. Recent changes by HUD now allow non-borrowing spouses to remain in the home after the borrower’s death, as long as certain conditions are met. This provision can provide a significant financial safety net for older couples with a large age gap between partners.

2. Utilize the Line of Credit Option:

One key benefit of reverse mortgages is the line of credit (LOC) feature, where you can draw funds as needed instead of receiving a lump sum. The unused portion of the LOC grows over time, which means you’ll have increased access to funds in the future. This is particularly useful as a growing financial reserve, offering peace of mind as you age.

3. Consider the Home Equity Conversion Mortgage for Purchase (HECM):

If you're looking to downsize, relocate, or move closer to family, the Home Equity Conversion Mortgage for Purchase (HECM) allows you to buy a new home using your reverse mortgage. This allows you to purchase a new principal residence without adding a new monthly mortgage payment—an ideal option for seniors who want to make a lifestyle change without financial strain.

4. Refinance If Your Home’s Value Increases:

If your home has appreciated in value, refinancing your reverse mortgage may be a good option. Refinancing allows you to access more of your home’s equity, increasing your line of credit or even receiving additional funds. While there are associated costs, refinancing could offer substantial financial benefits, especially if home values are on the rise.

5. Monitor Interest Rates:

Interest rates directly impact how much you can borrow with a reverse mortgage. If rates are low, it could be a good time to take advantage of favorable borrowing conditions. Additionally, lower interest rates can help maximize your principal limit, which increases the amount of funds you can access.

6. Modify Payment Options to Suit Your Needs:

Reverse mortgages offer various payment options, including lump sums, monthly payments, or lines of credit. You can even modify these payment options as needed. Depending on your financial situation, adjusting the terms could maximize your benefits by providing funds most effectively for your unique circumstances.

Conclusion:

In conclusion, reverse mortgages provide a powerful tool for seniors seeking to improve their financial situation during retirement. As data shows, many retirees are facing financial difficulties, including dwindling savings, high debt, and reliance on Social Security. By leveraging the benefits of reverse mortgages, retirees can tap into their home equity to supplement their income and secure a more comfortable lifestyle. Utilizing strategies like refinancing, taking advantage of the Home Equity Conversion Mortgage for Purchase (HECM), and making use of the growing line of credit can help maximize the financial advantages of reverse mortgages.

About Equity Access Group:

Equity Access Group specializes in providing financial solutions tailored to the needs of retirees. Our mission is to help seniors achieve financial stability and peace of mind through products like reverse mortgages. EAG offers personalized consultations to help you understand the benefits and determine if a reverse mortgage is the right fit for your retirement plan.

Jason Nichols

Equity Access Group

+1 888-391-4324

info@equityaccessgroup.com

REVERSE MORTGAGES — an expert Mortgage Lender's BEST-KEPT SECRETS

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release